Beijing has prioritized financial innovation for sustainability, says the vice-chairman and executive director of the Paulson Institute.

BY Deborah Lehr, Vice Chairman and Executive Director

The money needed to save our planet is daunting. Experts say $2.4trn is required every year up to 2035 to meet the goals of the Paris Agreement. Reversing the global decline of biodiversity alone will require more than $700bn annually over the next ten years, according to the Paulson Institute.

Governments cannot meet these financial demands alone. The private sector must play a role, and innovation is key to unlocking the capital required.

One important part of the solution is to scale up digital financial technologies. Global fintech lending increased from $125bn in 2015 to $400bn in 2017, while the number of mobile money subscribers grew from 2011’s 60 million to 400 million in 2015. The challenge for policymakers is to leverage this growth and align new technologies with green development goals.

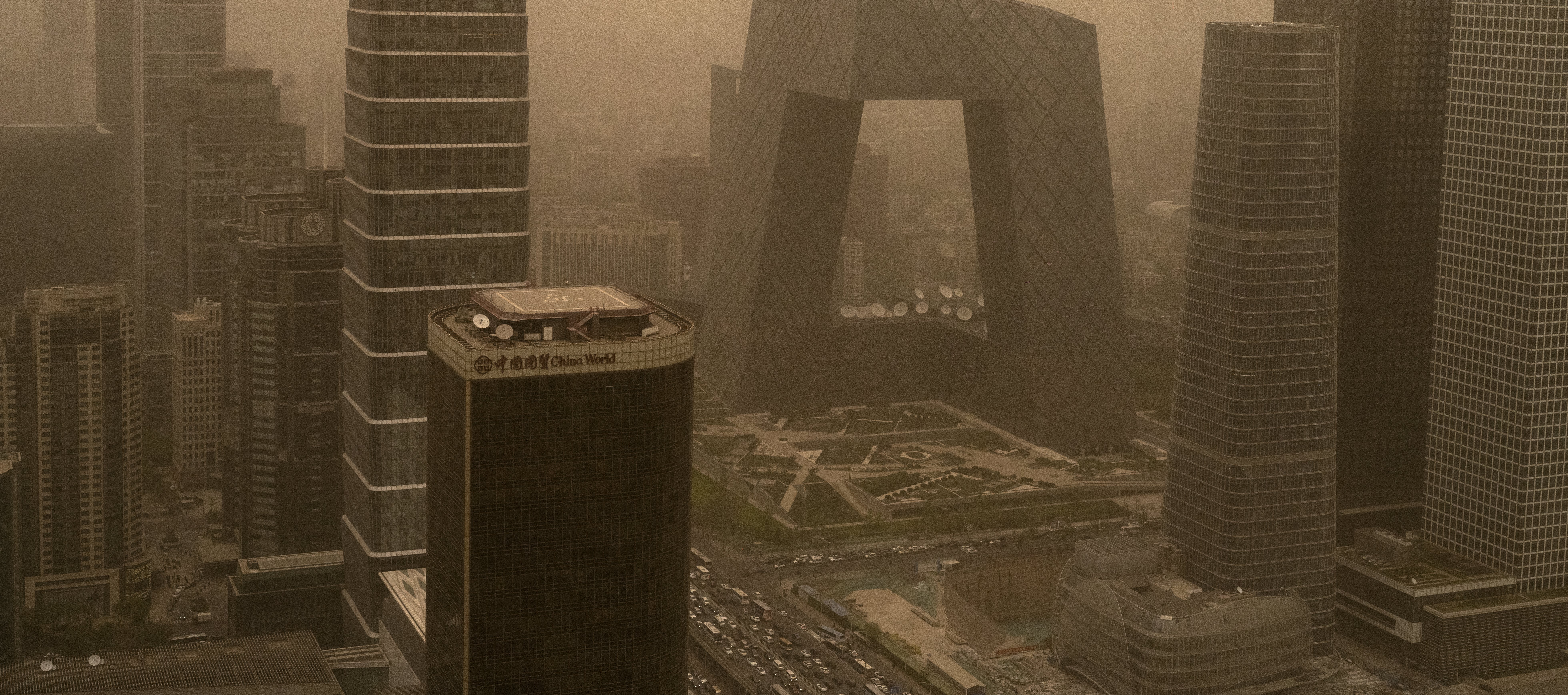

China, which last year announced its target of being carbon-neutral by 2060, offers some useful lessons, especially for emerging markets, where the financial—and, in many cases, environmental—demands are the greatest. In Zhejiang province, for example, 36 banks are part of a pilot to calculate the environmental risk of local firms. Banks rank state-owned enterprises and small and medium-sized firms for their “sustainability performance.” Such rankings create public pressure on a company to improve its behavior.

Also, the “greener” the firm, the more opportunity there is to receive financial benefits through loans with lower interest rates and fundraising from green bonds, and to attract investment. Analyses from another pilot in the city of Huzhou show there is a direct correlation China’s path to a green economy is paved with fintech between economic performance and a higher environmental score. In addition, firms that score well on the environmental risk analysis qualify for an online green finance service platform, an initiative of the city government.

China’s fintech innovations also extend to environmental, social and governance (ESG) investing. Harvest Fund, one of the country’s biggest mutual funds, developed an ESG rating system that allows investors to assess ESG performance, driving additional capital towards sustainability. There are lessons to be learned here.

For one, fintech is a powerful tool for collecting and analyzing environmental data, providing more accurate information on green investing, and reaching those outside the banking system to provide access to capital. It can also help provide better guidance for investors.

Second, China didn’t become a green fintech leader by accident, but because green finance was made into a national strategic imperative. China created green finance zones that are dedicated to sustainable development. As a result, it is now a global testing ground for innovation in green finance.

Internationally, much more work needs to be done: environmental data quality needs improvement, common green standards are lacking, and capacity building across the financial system is needed. But fintech offers the potential to unlock significant amounts of capital.

If policymakers can come together to create a common taxonomy and regulatory framework, and a compatible technical infrastructure, particularly at the G20 level, it can have a significant global impact.

This article first appeared in the New Statesmen and the latest edition of Spotlight on fintech. Click here to download the full edition.