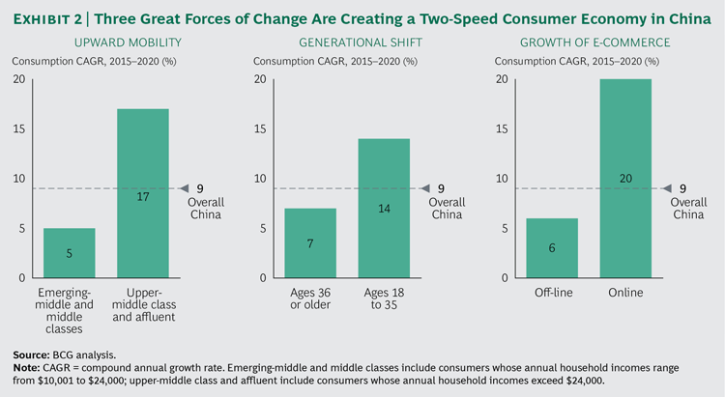

Amid growing concerns about China’s slowing economy, a recent research report by BCG and Alibaba* argues that China’s consumer economy is going gangbusters. Consumption growth will be driven by the dramatic rise of upper-middle-class households ($24,001 to $46,000 in annual disposable income) and affluent households (more than $46,000). By 2020, the study projects, the number of upper-middle-class and affluent households will double to 100 million and account for 30% of all urban households, compared with 17% today and only 7% in 2010. Furthermore, upper-middle-class and affluent households will account for 55% of Chinese urban consumption and 81% of its incremental growth over the next five years.

Consumption among upper-middle-class and affluent households is growing at 17% per year and, by 2020, will account for $1.5 trillion in incremental spending in urban China. That compares with a 5% growth rate among emerging-middle-class and middle-class consumers.

Question: Does this suggest that China’s super-wealthy are leaving the less affluent even further behind?

*Alibaba CEO Jack Ma is a member of the Paulson Institute’s CEO Council for Sustainable Urbanization, which is working to harness the power of business to help China achieve its ambitious urbanization goals in a sustainable way.